下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

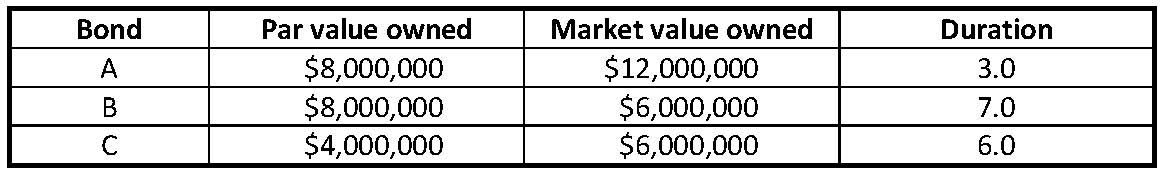

1、A portfolio manager holds the following three bonds, which are option free and have the indicated durations.

The portfolio’s duration is closest to:【单选题】

A.4.75.

B.5.20.

C.5.33.

正确答案:A

答案解析:“Introduction to the Measurement of Interest Rate Risk,” Frank J. Fabozzi, CFA

2013 Modular Level I, Vol. 5, Section 4.8

Study Session 16-58-g

Calculate the duration of a portfolio, given the duration of the bonds comprising the portfolio, and explain the limitations of portfolio duration.

A is correct because the portfolio’s duration is a weighted average of the durations of the individual holdings, computed as:

(12/24) × (3.0) + (6/24) × (7.0) + (6/24) × (6.0) = 4.75.

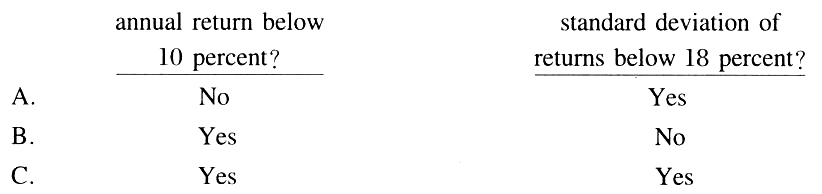

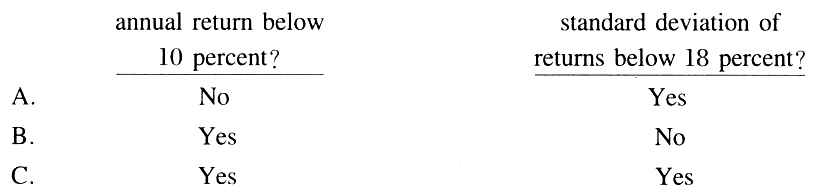

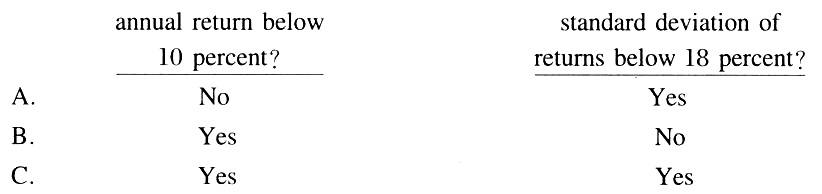

2、An investor does research about annual return and standard deviation of returns,and is considering the purchase of two securities issued by different companiesoperating in different industries.Each security has an expected annual return of10 percent and an expected standard deviation of returns of 18 percent.Regardlessof the weights selected, will a portfolio composed of the two securities mostlikely have an expected:【单选题】

A.

B.

C.

正确答案:A

答案解析:投资组合中两个证券的投资收益率都为10%,不管是什么权重,最后投资组合的收益率也为10%。两个证券来自不同的行业,说明它们的相关系数至少不为l。如果相关系数是1,则两个资产组合的收益率标准差为18%。如果相关系数小于1,则这两个资产组合的收益率标准差小于18%。

3、An analyst does research about difference between Generally Accepted AccountingPrinciples (U.S.GAAP) and International Financial Reporting Standards (IFRS).The indirect method of presenting cash flow from operation is NOT allowed under?【单选题】

A.IFRS only.

B.U.S.GAAP only.

C.Neither IFRS nor U.S.GAAP.

正确答案:C

答案解析:无论是IFRS还是U.S.GAAP,都允许用间接法(indirect method)和直接法(direct method)编制现金流量表,但鼓励用直接法。

4、A company, which prepares its financial statements in accordance with IFRS is in the process of developing a more efficient production process for one of its primary products. The most appropriate accounting treatment for those costs incurred in the project is to:【单选题】

A.expense them as incurred.

B.capitalize costs directly related to the development.

C.expense costs until technical feasibility has been established.

正确答案:C

答案解析:“Long-Lived Assets,” Elaine Henry, CFA, and Elizabeth A. Gordon

2011 Modular Level I, Vol.3, pp. 418-419.

Study Session: 9-37-a

Distinguish between costs that are capitalized and costs that are expended in the period in which they are incurred.

Under IFRS research and development costs are expensed until certain criteria are met, including that technical feasibility has been established and the company intends to use it.

5、An investor purchases the bonds of JLD Corp., which pay an annual coupon of 10% and mature in 10 years, at an annual yield to maturity of 12%. The bonds will most likely be selling at:【单选题】

A.par.

B.a discount.

C.a premium.

正确答案:B

答案解析:“Risks Associated with Investing in Bonds,” Frank J. Fabozzi, CFA

2013 Modular Level I, Vol. 5, Section 2.1

Study Session 15-53-b

Identify the relations among a bond’s coupon rate, the yield required by the market, and the bond’s price relative to par value (i.e., discount, premium, or equal to par).

B is correct because the coupon rate on the bonds is lower than the yield to maturity, implying that the bonds should be selling at a price lower than their par value—that is, at a discount.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料