下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2022年CFA考试《CFA一级》试题共240道,均为单选题。帮考网为大家整理了精选模拟习题10道,附答案解析,帮助各位小伙伴考前自测提升!

1、An analyst does research about the reported revenue of a company and gathers thefollowing information about a product:

Assume that the company bears no inventory risk forthe product and uses net reportingof revenue, reported revenue of the product is closest to:【单选题】

A.$50

B.$90

C.$100

正确答案:C

答案解析:net reported revenue = revenue - cost of goods sold = $140 - $40 = $100。

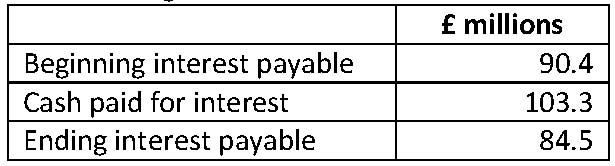

2、The following annual financial data are available fora company:

Interest expense forthe year is closest to:【单选题】

A.71.6.

B.97.4.

C.109.2.

正确答案:B

答案解析:“Understanding Cash Flow Statements,” Elaine Henry, CFA, Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, and Michael A Broihahn, CFA

2013 Modular Level I, Vol. 3, Section 3.2.1.5

Study Session: 8-27-f

Describe the steps in the preparation of direct and indirect cash flow statements, including how cash flows can be computed using the income statement and balance sheet data.

B is correct. Interest expense is equal to ending interest payable plus cash paid forinterest less beginning interest payable. The calculation is as follows:

3、A review of a company’s inventory records forthe year indicates that the following costs were incurred:

Fixed production overhead: $500,000

Direct material and direct labor: 300,000

Storage costs incurred during production: 25,000

Abnormal waste costs: 30,000

If the company operated at full capacity during the year, the total capitalized inventory cost is closest to:【单选题】

A.$800,000.

B.$825,000.

C.$855,000.

正确答案:B

答案解析:“Inventories,” Michael A. Broihahn, CFA

2011 Modular Level I, Vol. 3, pp. 379-380

Study Session 9-36-a

Distinguish between costs included in inventories and costs recognized as expenses in the period in which they are incurred.

The total capitalized costs include fixed production costs, the direct conversion costs of material and labor, storage costs required as part of production but not abnormal waste costs. $500,000 + 300,000 + 25,000 = $825,000

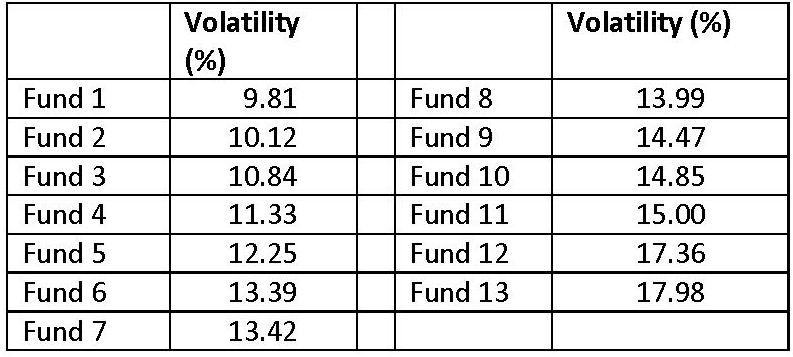

4、The following table shows the volatility of a series of funds that belong to the same peer group, ranked in ascending order:

The value of the first quintile is closest to:【单选题】

A.10.70%.

B.10.84%.

C.11.09%

正确答案:A

答案解析:“Statistical Concepts and Market Returns,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 7, Section 6.1

Study Session 2–7–f

Calculate and interpret quartiles, quintiles, deciles, and percentiles.

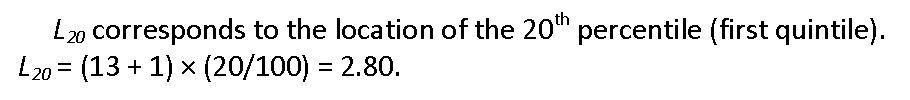

A is correct. First, find the position of the first quintile with the following formula:

where

y is the percentage point at which we are dividing the distribution. In our case we have y = 20, which corresponds to then is the number of observations (funds) in the peer group. In our case we have n = 13;

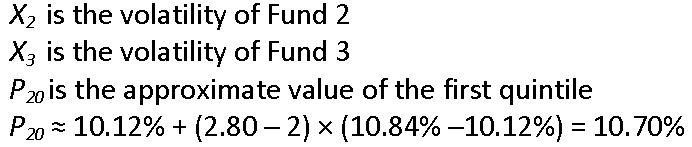

Therefore, the location of the first quintile is between the volatility of Fund 2 and Fund 3 (because they are ranked in ascending order).

Then, use linear interpolation to find the approximate value of the first quintile:

where

5、Duration is most accurate as a measure of interest rate risk fora bond portfolio when the slope of the yield curve:【单选题】

A.increases.

B.decreases.

C.stays the same.

正确答案:C

答案解析:“Risks Associated with Investing in Bonds,” Frank J. Fabozzi

2012 Modular Level I, Vol. 5, pp. 359–363

Study Session 15-54-g

Describe yield-curve risk, and explain why duration does not account foryield-curve risk.

C is correct because duration measures the change in the price of a portfolio of bonds if the yields forall maturities change by the same amount; that is, it assumes the slope of the yield curve stays the same.

6、Umi Grabbo, CFA, is a highly regarded portfolio manager forAtlantic Advisors (AA), a mid-sized mutual fund firm investing in domestic securities. She has watched the hedge fund boom and on numerous occasions suggested her firm create such a fund. Seniormanagement has refused to commit resources to the area. Attracted by potential higher fees associated with hedge funds, Grabbo and several other employees organize a hedge fund to invest in international securities. Grabbo is careful to work on the fund development only on her own time. Because AA management thinks hedge funds are a fad, she does not inform her supervisorabout the hedge fund creation. According to the Standards of Practice Handbook, Grabbo should most likely address which of the Standards immediately?【单选题】

A.Disclosure of Conflicts.

B.Priority of Transactions.

C.Additional Compensation Arrangements.

正确答案:A

答案解析:“Guidance forStandards I-VII”, CFA Institute

2010 Modular Level I, Vol. 1, pp. 75, 89-92, 94-98

Study Sessions 1-2-a

Demonstrate a thorough knowledge of the Code of Ethics and Standards of Professional Conduct by applying the Code and Standards to situations involving issues of professional integrity.

According to Standard VI (A) Disclosure of Conflicts, Grabbo should disclose to her employer the fact she is developing a hedge fund that could possibly interfere with her responsibilities at AA. In setting up a new fund, Grabbo was not acting forthe benefit of her employer. She should have informed AA that she wanted to organize a hedge fund and come to some mutual agreement on how this would occur.

7、Albert Nyakenda, CFA, was driving to a client’s office where he was expected to close a multi-million dollar deal, when he was pulled over by a traffic policeman When Nyakenda, realized the policeman planned to wrongly ticket him forspeeding, he offered to buy him “lunch” so that he could quickly get to his client’s office. The alternative was to go to the police station and file a complaint of being wrongly accused that would also involve going to court the next day to present his case. The lunch would cost significantly more than the ticket. Did Nyakenda violate the CFA Code of Ethics?【单选题】

A.Yes.

B.No, because he was wrongly accused.

C.No, because the cost of lunch is more than the ticket.

正确答案:A

答案解析:“Guidance forStandards I-VII”, CFA Institute

2010 Modular Level I, Vol. 1, p. 11

Study Session 1–2–a, b

Demonstrate a thorough knowledge of the Code of Ethics and Standards of Professional Conduct by applying the Code and Standards to situations involving issues of professional integrity.

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.

Nyakenda was effectively trying to bribe the policeman so that he would not issue a speeding ticket. This action violates the Code of Ethics. Despite feeling he was wrongly accused, it is only his opinion, and may not based on fact orin a court of law. Nyakenda has a responsibility to act with integrity and in an ethical manual.

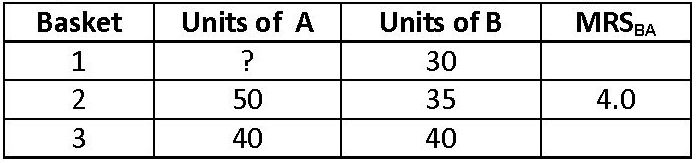

8、Partial information on three baskets containing goods A and B is given in the table below. Themarginal rate of substitution of B forA,

at Basket 2 is also provided.

A consumer’s indifference curves are strictly convex and he claims that he is indifferent between Baskets 2 and 3. If he is also indifferent between Baskets 1 and 3, the number of units of A in basket 1 is most likely:【单选题】

A.equal to 60.

B.less than 60.

C.greater than 60.

正确答案:C

答案解析:“Demand and Supply Analysis: Consumer Demand,” Richard V. Eastin and Gary L. Arbogast, CFA

2013 Modular Level I, Vol. 2, Reading 14, Section 3.3, Example 2

Study Session 4–14–a, b

Describe consumer choice theory and utility theory.

Describe the use of indifference curves, opportunity sets, and budget constraints in decision making.

C is correct. Because the consumer is indifferent between all three baskets, they must all fall on the same indifference curve. The

at Basket 2 is 4, meaning that the slope of theindifference curve at that point is –4, hence

Solve forA = 70: greater than60.

9、Matthew Murphy, CFA, is an analyst at Divisadero Securities &; Co..If Murphylives and works in a country where applicable laws differ from the requirement ofthe Code of Ethics and Standards of Professional Conduct,:【单选题】

A.Murphy must comply to the applicable local law of the country.

B.Murphy must comply to the Code of Ethics and Standards of ProfessionalConduct.

C.Murphy must comply to the stricter of the applicable local law of the countryorthe Code of Ethics and Standards of Professional Conduct.

正确答案:C

答案解析:在所适用的法律与伦理道德标准之间,CFA会员应该遵守更加严格的法律条例。

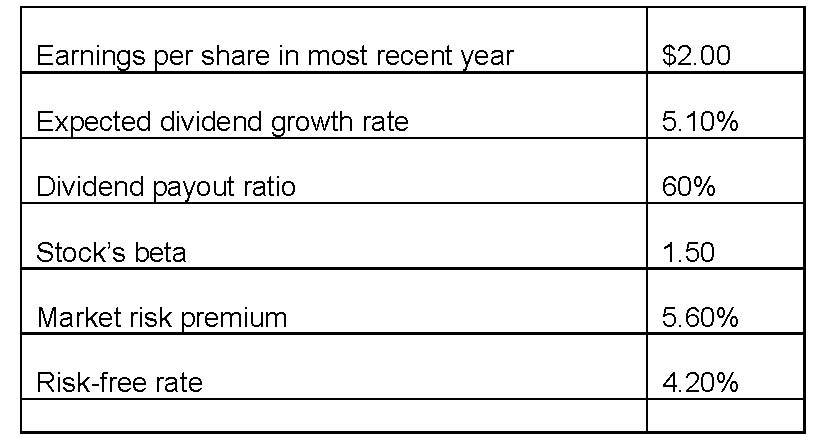

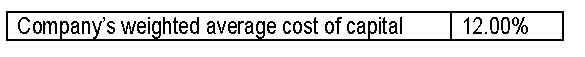

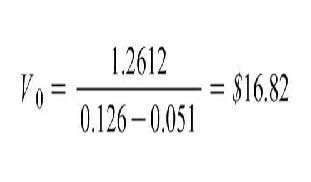

10、An analyst gathers the following data about a company and the market:

Using the dividend discount model, the company’s price per share is closest to:【单选题】

A.$18.28.

B.$16.00.

C.$16.82.

正确答案:C

答案解析:

where

r = required rate of return on the stock

r = Risk-free rate +

(Market risk premium)

r = 4.2 + (1.5 × 5.6) = 12.6%

2014 CFA Level I

“Portfolio Risk and Return: Part II,” by Vijay Singal Section 3.3.1 “Equity Valuation: Concepts and Basic Tools,” by John J. Nagorniak and Stephen E. Wilcox

Section 4.2

以上就是本次帮考网为大家带来的全部内容,如果大家还有不清楚的,请持续关注帮考网,我们将继续为大家答疑解惑,并带来更多有价值的咨询!

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料