下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

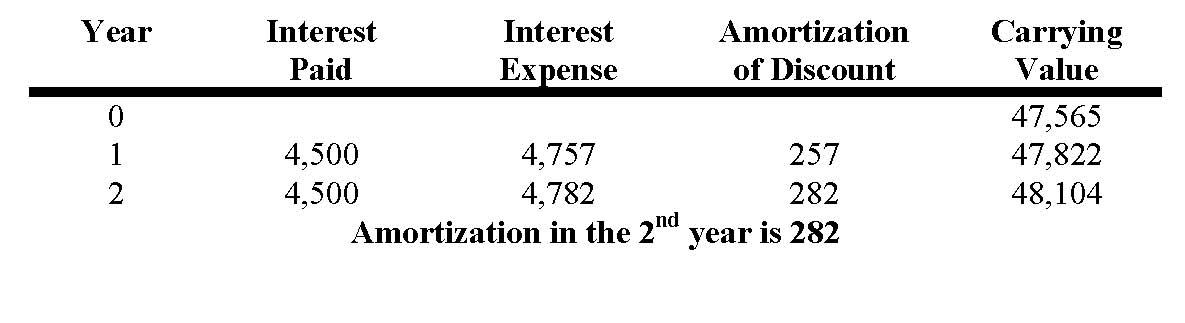

1、A company issued a $50,000 7-year bond for $47,565. The bonds pay 9 percent per annum and the yield-to-maturity at issue was 10 percent. The company uses the effective interest rate method to amortize any discounts or premiums on bonds. After the first year, the yield to maturity on bonds equivalent in risk and maturity to these bonds is 9 percent. The amount of the bond discount amortization ($) recorded in the second year is closest to:【单选题】

A.282.

B.348.

C.2,178.

正确答案:A

答案解析:“Long-term Liabilities and Leases,” Elizabeth A. Gordon and R. Elaine Henry, CFA

2010 Modular Level I, Vol. 3, pp.520-523

Study Session 9-39-a

Compute the effects of debt issuance and amortization of bond discounts and premiums on financial statements and ratios.

Interest paid = Market rate at issue x Issued amount of bonds = 9% x $50,000

Interest expense = Market rate at issue x Carrying (BV) of bonds

Amortization of discount = Interest expense - Interest paid

2、Hui Chen, CFA, develops marketing materials for an investment fund he founded three years ago. The materials show the three-year, two-year and one-year returns for the fund. He includes a footnote that states in small print "Past performance does not guarantee future returns." He does not claim compliance with the GIPS standards in the disclosures or footnotes. He also includes a separate sheet showing the fund's most recent semiannual and quarterly returns, which notes that those returns have been neither audited nor verified. Has Chen most likely violated any Codes and Standards?【单选题】

A.Yes, because he did not adhere to the Global Investment Performance Standards

B.No

C.Yes, because he included unaudited and unverified results

正确答案:B

答案解析:The Standards require members to make reasonable efforts to make sure performance information is fair, accurate, and complete. The Standards do not require compliance with the (GIPS) standards, auditing, or verification requirements. See Standard III(D).

2014 CFA Level I

"Guidance for Standards I-VII," CFA Institute

3、Which of the following institutional investors is most likely to have the lowestrisk tolerance?【单选题】

A.Banks.

B.Endowments.

C.Defined benefit pension plan.

正确答案:A

答案解析:银行的风险承受能力较低,因为银行必须要保持低风险并且需要充分的流动性来满足储户取款的要求。捐赠基金是为某个特殊目的而成立的基金,具有较高的风险容忍度。而给定领取型养老基金(defined benefit pension plan),作为养老金通常有相当长的投资期限,其基于员工收入为受托人提供长期的收入保障,所以风险承受能力也较高。

4、An analyst does research about the inventory write-down.A reversal of an inventorywrite-down from a previous period is most likely reported as a(n):【单选题】

A.unrealized gain.

B.decrease in the cost of sales.

C.increase in the inventory valuation allowance.

正确答案:B

答案解析:存货的减值:如果存货的成本高于现时的公允价值,此时就需要对存货进行减值,以反映出其真实价值。

IFRS : lower of cost or net realizable value(NRV)

NRV = expected selling price - estimated selling cost

如果NRV低于资产负债表上的账面价值(carrying value),则存货要减值并在利润表上显示为losses。如果日后要恢复,那么就加值,gains反映为当期销货成本(COGS)的减少,记入利润表中。但账面价值不能超过原始成本。

5、All else being equal, which of the following most likely increase credit quality?A company decreases its:【单选题】

A.margin stability.

B.retained cash flow.

C.dividend payout ratio.

正确答案:C

答案解析:派发给股东的股利越少,在公司里留给债权人的现金就越多,对债权人也越有利,并会增加公司的信用质量;减少利润率的稳定性和留存的现金流,都会降低公司的信用质量。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料