下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

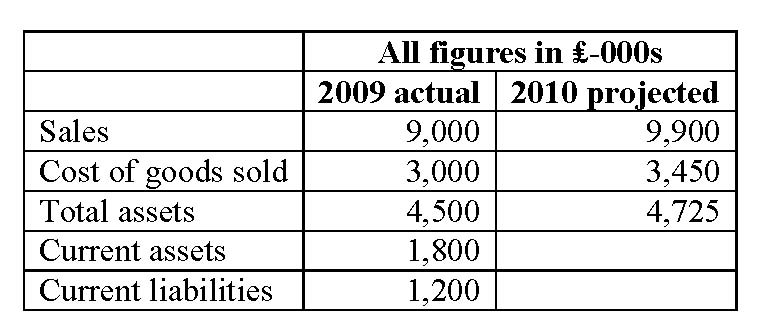

1、Information about the 2009 actual results for a company and its projected sales, cost of goods sold and assets for 2010 are presented below:

Based on the projected sales increase, the best estimate of 2010 projected current assets (in ?- 000s) is closest to:【单选题】

A.1,890.

B.1,980.

C.2,070.

正确答案:B

答案解析:“Financial Statement Analysis,” Pamela P. Peterson, CFA

2010 Modular Level I, Vol. 4, pp. 153-159

Study Session 11-47

The candidate should be able to demonstrate the use of pro forma income and balance sheet statements.

Current assets are sales driven and hence would be expected to increase by 10%, the same amount as sales. The increase in sales is (9,900,000 – 9,000,000)/9,000,000 = 10%. Therefore, projected current assets are 1.10 x 1,800,000 = 1,980,000.

2、An analyst does research aboutembedded options.Which of the following embeddedoptions is least likely to increase in value when interest rates increase?【单选题】

A.The right toput an issue.

B.The cap on a floater.

C.An accelerated sinking fund provision.

正确答案:C

答案解析:由于利率上升,对于浮动利率债券的利率顶的价值上升,因为更有可能超过其所设定的利率顶,而超过利率顶时,购买者就能得到报偿。由于利率上升,可回售债券价格下跌,被回售的可能性增加了,所以回售债券的权利增加价值了。加速沉没资金条款是公司可以选择提前偿还全部或部分本金,在利率下跌的情况下,该条款更有价值,因为可以更低成本进行融资,所以在利率上升的情况下,该权利减少价值。

3、The crowding-out effect is most likely associated with:【单选题】

A.falling real interest rates.

B.government budget deficits.

C.government budget surpluses.

正确答案:B

答案解析:“Fiscal Policy,” Michael Parkin

2011 Modular Level I, Vol. 2, pp. 440-441

Study Session 6-26-b

Discuss the sources of investment finance and the influence of fiscal policy on capital markets, including the crowding-out effect.

The tendency for a government budget deficit to decrease private investment is called the crowding-out effect.

4、The bond-equivalent yield for a semi-annual pay bond is most likely:【单选题】

A.equal to the effective annual yield.

B.more than the effective annual yield.

C.equal to double the semi-annual yield to maturity.

正确答案:C

答案解析:“Discounted Cash Flow Applications,” Richard A. Defusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2010 Modular Level I, Vol. 1, pp. 255-257

Study Session 2-6-e

Convert among holding period yields, money market yields, effective annual yields, and bond equivalent yields.

The bond equivalent yield for a semi-annual pay bond is equal to double the semiannual yield to maturity (page 257).

5、An investor purchases 100 shares of stock at a price of $40 per share. The investor holds the stock for exactly one year and then sells the 100 shares at a price of $41.50 per share. On the date of sale, the investor receives dividends totaling $200. The holding period return on the investment is closest to:【单选题】

A.3.75%.

B.8.43%.

C.8.75%.

正确答案:C

答案解析:“Discounted Cash Flow Applications,” Richard A. Defusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2011 Modular Level I, Vol. 1, p. 319

Study Session 2-6-c

Define, calculate, and interpret a holding period return (total return).

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料